As with the checking accounts, the higher-level savings accounts, which offers higher interest rates, has tighter requirements for avoiding the monthly service fee. This includes either a $15,000 minimum daily balance or having the account linked to a high-level checking account. With Chase, most of the accounts come with monthly service fees; some of these fees are easy enough to avoid, and others require very large balances to waive. The Chase savings account comes with a $5 monthly fee, which will be waived by maintaining at least a $300 balance.

You can also waive the fee by linking it with a premium checking account. Monthly fees for the Chase checking accounts range from $12 to $25. The minimum balance required to keep the fee at bay ranges from $1,500 to $75,000. The monthly service fee for a Total Checking account is $12, but there are ways that you can get that service fee waived. Total Checking requires a minimum deposit of $25 to open an account. That $12 fee is cut in half for students currently enrolled in high school or college.

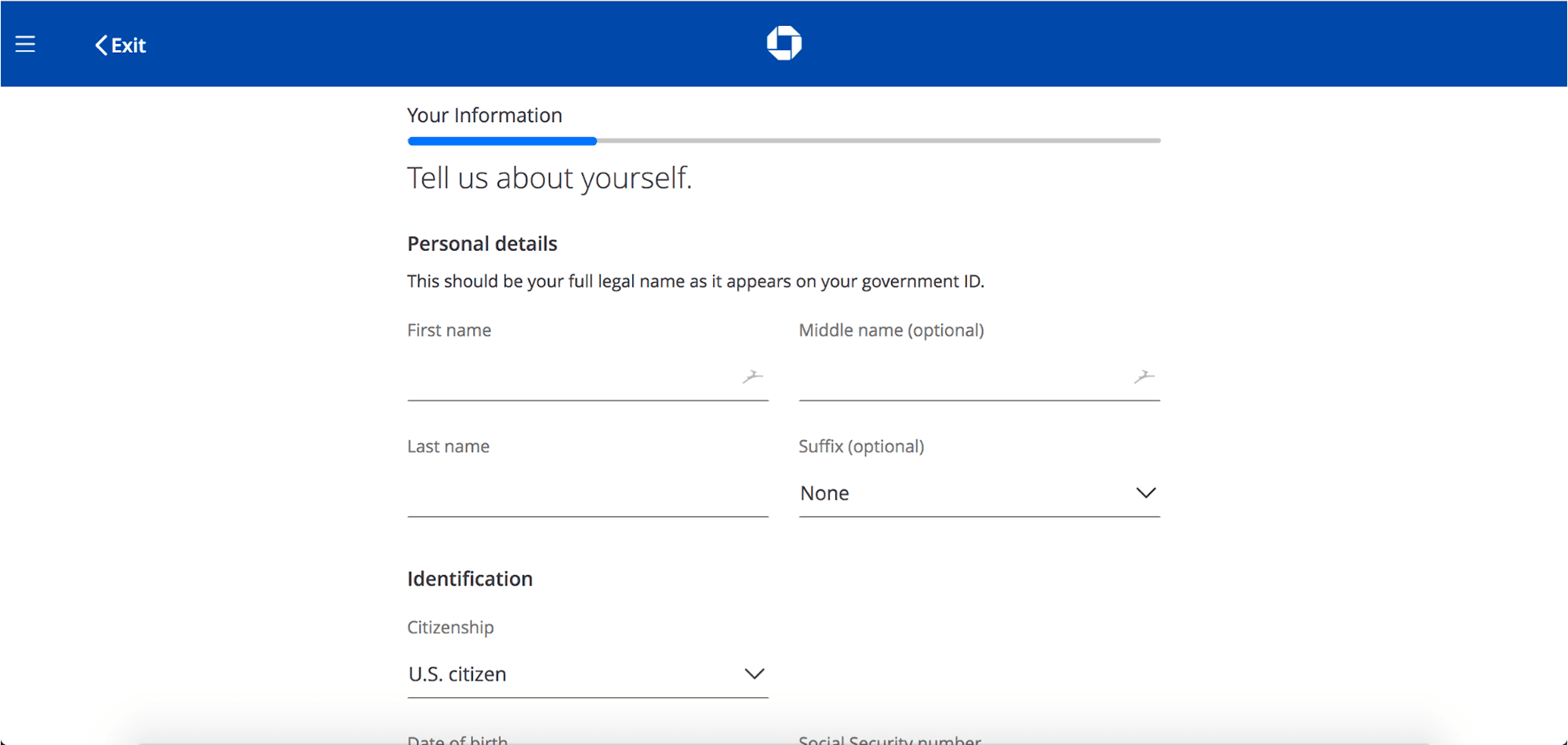

Total Checking account holders pay no Chase ATM fees at any in-network ATM and deposits can be made at in-network ATMs as well. Total Checking account holders also have full and free access to Chase's online banking and online bill paying features. Once your application has been approved, you'll need to fund your account.

If you're opening it at a physical branch, you can use a personal check linked to another checking account or cash. If you're processing the account online, you can link a debit card or checking account number to do a bank transfer, or you can use a non-Chase credit card to fund up to $500. However, saving account fees are waived if you have a savings account that is tied to a Premier Plus or Premier Platinum checking account.

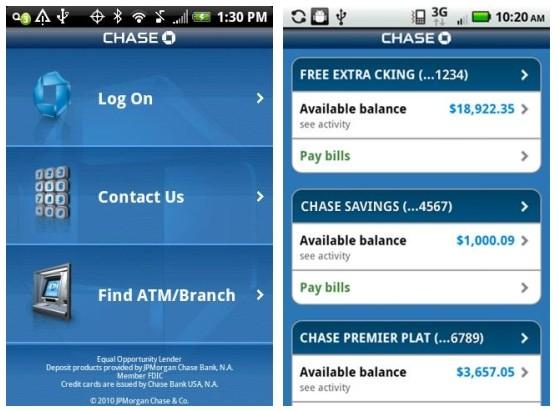

If you have a Chase savings account and you are under 18 years old, there is no monthly service fee. However, you'll pay a $25 monthly fee if you can't keep a $15,000 balance in all of your Chase bank accounts and partner investment accounts combined. All of the Chase checking accounts provide free online bill payment and access to a mobile banking service for your cell phone or other mobile devices. In addition, you can view canceled checks on your online statements. Chase also offersfree ATM transactions at Chase Bank ATM locations. You should also expect zero liability protection on their ATM/debit cards in addition to the standard protection offered by VISA check cards.

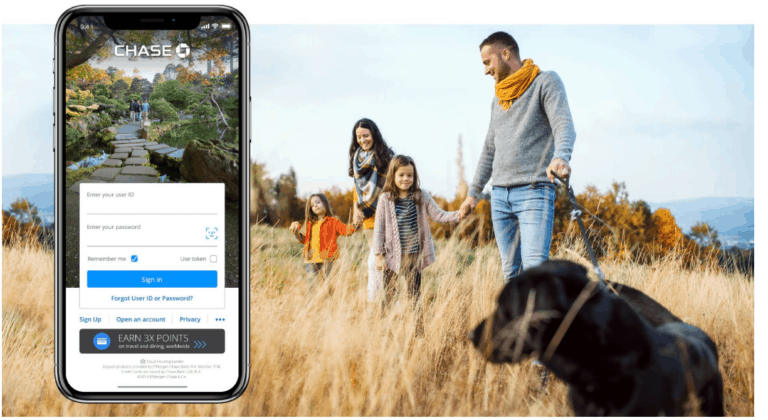

If your card is used in an unauthorized manner, Chase Bank will refund your money to your account. When it comes to free checking accounts, Chase Bank does not have a completely free account like the U.S. However, it does have a few fee-waivable checking account options to choose from. These include the Chase Total Checking, Chase Premier Plus Checking, and Chase Sapphire Checking accounts. At the same time, Chase maintains a robust suite of online and mobile banking services through its desktop site and app.

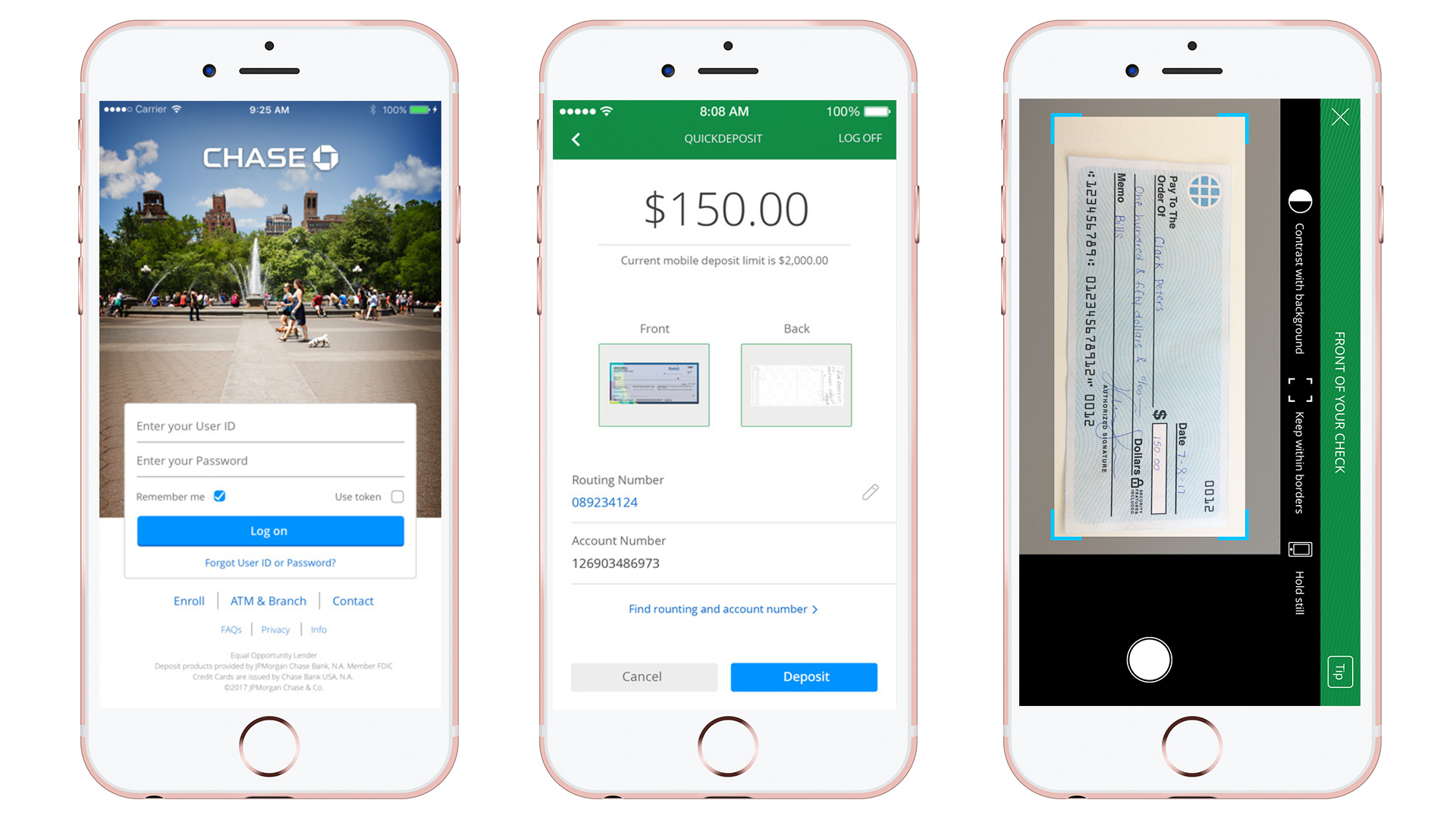

You can use the website or mobile app to check your balance, make transfers and set up online bill pay, among other features. The mobile app, which maintains a 4.8 rating on the Apple App store, lets you deposit checks right from your phone. Whether you want to bank online or in-person, Chase has you covered. Of the three accounts, the Chase Total Checking account has the most lenient requirements for waiving the service fee. It requires $500 in direct deposits, a $1,500 beginning day balance, or an average beginning day balance of $5,000 to waive the $12 monthly service fee from Chase. The other two accounts require higher daily balance requirements to waive a $25 monthly fee.

But unlike the Chase Total Checking account, these accounts accrue interest. U.S. Bank offers a debit card and free internet banking with bill pay for all of its free and fee-waivable checking accounts. Additionally, the bank employs a mobile banking system that is compatible with many web-based mobile devices so that you can check your account on the go or deposit checks for free.

Bank archives all checks electronically and provides either details about or images of canceled checks in your statements, depending on your account. In terms of interest rates, Chase falls significantly behind Ally across the board. For savings accounts, the Chase interest rates range from 0.01% to 0.11%; at the low end, you'd only receive $1 per year in interest on an account balance of $10,000. Rising above 0.01% requires you to meet certain balance thresholds, though, and getting the maximum rate of 0.11% requires a minimum account balance of $250,000 and a linked checking account. The Ally savings account offers a 1.90% rate, with no requirements of any kind. The Chase Sapphire Checking account has a a minimum opening deposit of $100 and a $25 monthly fee, and you'll need an average daily balance of $75,000 to avoid that fee.

You can use any ATM on the planet without having to pay a fee; not only are there no ATMs fees charged by Chase, but Chase will also refund you any fees charged by the ATM owner. The account also allows you to access money orders and cashier's checks without fees, and having this account automatically waives the monthly fee for any Chase savings account you have. This youth checking account charges no monthly fees and has no minimum balance requirement once you open it with at least $25. Parents can sign up for account alerts, transfer money into the account and choose whether or not the child can transfer money and make deposits.

You also may request an ATM/debit card, which can be used at over 60,000 USAA-friendly ATMs. The account's adult co-owner also has the ability to limit or disable ATM and debit card usage by the minor. With the Chase Sapphire CheckingSM Account you can earn a fantastic bonus when you meet all the requirements. If you are also interested, consider opening a Chase Sapphire Preferred® Credit Card.

You can also avoid paying the fee with a combined daily average of $5,000 across all your Chase accounts. You'll get a full suite of features, including overdraft protection, access to free withdrawals at Chase ATMs, mobile banking, and online bill pay. As long as you meet the minimum requirements, you won't pay a monthly service fee with this account.

Signing up for Chase Secure Banking is an easy way to earn a quick $100 cash bonus and access basic banking services without all of the extra fees. Unfortunately, the checking account charges a $4.95 monthly service fee, so if you want a completely free checking account, you'll need to look elsewhere. Chase Secure Banking offers enough benefits to make it a viable option as an everyday checking account, especially with access to plenty of local branches and fee-free ATMs across the country. The Chase Total Checking® account offers a $225 bonus for new customers and a top-rated mobile app that makes banking easy. With both physical and online banking options, you can tailor your experience to your needs.

Chase Total Checking ranks on our list of best checking account bonuses of 2021 because, in addition to the signing bonus, there is no minimum balance requirement to open a new account. When you compare the free checking account offerings of U.S. Bank offers an actual free checking account with no maintenance fees. While Chase Bank offers a variety of fee-waivable checking accounts, the monthly service fee on checking accounts at Chase can only be waived by meeting certain requirements. This means that someone who doesn't want to fuss with these requirements may find it easier to open a U.S. But depending on your financial situation, you may be able to meet the requirements of waiving the fee for a U.S.

Bank fee-waivable account or a checking account at Chase without much difficulty. Speaking of technology, Chase's incorporates all of your accounts with the bank. When you pull up your mobile account, for instance, you can get instant access to your checking and savings account balances, as well as your outstanding credit card balance. You can make transfers between accounts, wire money to a friend or family member, or pay bills all from your mobile. Chase definitely offers a wide variety of checking options to fit your individual needs. Furthermore, you can earn a wonderful bonus when you meet the requirements for your account.

Being one of the largest and advanced banking services you can have access to your account using the Chase mobile app or online banking service at any time. Chase Total Checking® is the bank's beginner checking account that offers basic value without the special perks of premium accounts. However, new account holders can earn a $225 checking bonus when they open a new Chase Total Checking account and set up direct deposit. Additionally, this Chase checking account features a monthly maintenance fee that is easy to get waived. For people who want to earn interest on their money, there is the Chase Premier Plus checking account.

The current interest rate paid on the balance of the account is 0.01% although that does change. The minimum amount required to open a Premier Plus checking account is $25. Bank offers three fee-waivable checking accounts—that is, the monthly fee can be waived if you meet certain requirements.

These accounts include the Easy Checking, Gold Checking, and Platinum Checking accounts. Besides no ATM fees and free, online investing, Sapphire Banking comes with a host of perks. Whether you're just starting college or have been hitting the books for a few years, if you don't have a checking account, it's a good idea to set one up. Checking accounts make it easy to handle your personal finances, including check deposits, bill payments and making online purchases. It's also safer to carry around a debit card instead of cash — if the former gets stolen, you can immediately shut down the card to prevent further losses.

As you'll see with the list below, Chase will give you a bonus if you open a bank account and meet their conditions. A checking account bonus will require you to open an account and set up a direct deposit. A savings account bonus will require you to open an account and deposit a minimum amount to get the bonus. The terms are easy to achieve and routine, nothing above and beyond what other banks request. I'd consider them all "easy" to achieve without any gotchas. It's important to read the fine print when you are opening a new account for a sign up bonus.

Most of these offers have requirements to earn the bonus offer. In general, you may be required to make a minimum initial deposit, maintain a minimum balance for a set period, set up direct deposit, or keep the account open for a certain amount of time. These types of offers generally aren't open to current customers or people who have earned a similar bonus within a certain time frame. I have a personal checking and savings account and I have both personal and business credit cards with Chase.

In my opinion, Chase has some of the best credit card offers around. Chase Private Client is one of the most premier services at Chase. You receive priority service, family benefits, business tools, 24/7 support, and financial specialists when you need them.

While requirements for this account can be steep it offers a wide variety of features that are worthwhile. The Chase Total Checking® + Chase SavingsSMaccounts are great options for new customers that just want a standard bank account. The Total Checking® Account at Chase is the most popular checking account. While there is a monthly service fee you can always waive it by meeting any of the requirements. Furthermore, while this checking account doesn't earn interest, when you pair it with the Savings AccountSM you can even earn a generous checking bonus.

Chase Private Client Checking℠ requires a $150,000 minimum daily balance in all your linked deposit and/or investment accounts to qualify for the waived service fee. If you have a linked business checking account, the fee may also be waived. I have the Chase app which allows me to transfer money and pay bills for them as they don't do anything online. This was always fine as I personally did not have accounts with Chase.

Recently we refinanced our home through Chase and I opened an Amazon Prime credit card, which is also through Chase. Both of my new accounts appeared in the Chase app without my setting them up (along with my parents' accounts). I am having difficulty adding an external account to pay my mortgage.

I added the account, but the only option to "Pay from" are my parent's accounts! Chase offers several tiers of checking and savings accounts. Each account grants its owner access to all of the bank's physical locations and ATMs as well as Chase's online banking and mobile app. • Some features are available for eligible customers and accounts only. Any time you review your balance, keep in mind it may not reflect all transactions including recent debit card transactions or checks you have written.

A qualifying Chase transfer account is required to transfer funds via text. There will be no fees to open the Chase current account and start earning cashback rewards. Customers will receive the cashback rewards without needing to switch their banking provider, commit to a minimum account balance or set up direct debits. The 1% cashback is payable when customers use their Chase debit card in person or online, and will be offered at retailers at home and abroad. In general, premium checking accounts are for high-balance customers. You get most of the perks and benefits when your balance is high.

If you meet that balance requirement via a brokerage account, that's one thing. But if you just let that much cash sit in your account so your monthly fee is waived and you get special perks, consider parking it in an high-yield savings account instead. Only you can decide if you'd like to become a Chase customer. Chase Secure Checking is the most basic checking experience you can sign-up for at Chase. While you do receive a debit card for opening this account there are really no other benefits and features to like about this account. The only reason I'd recommend this account is if you have poor credit and are trying to fix your finances.

Furthermore you do not receive checks and there is a $4.95 monthly service fee. The Chase Premier Plus CheckingSM Enjoy more benefits and earn interest on your new Chase checking account. No Chase fee on first four non-Chase ATM transactions per statement period. Chase Total Checking accounts have a $12 monthly fee for everyone except students. Total Checking account fees can be waived if you have a daily balance of $1500 or more. You can also get the monthly fee waived if you have more than $500 in Direct Deposits each month into the account.

The third way to avoid paying the monthly fee is to maintain $5000 or more in deposits or investments across several Chase accounts. Chase Total Checking® is a good option if you want a basic checking account, because it's easy to waive the $12 monthly service fee. You just have to electronically deposit $500 per month, start each day with a $1,500 balance, or maintain a daily average balance of $5,000 in all of your Chase accounts.

Open a new Chase College Checking account online or in a branch. Complete at least 10 qualifying transactions within 60 days of account opening. Qualifying transactions are debit card purchases, online bill payments, checks paid, Chase QuickDeposit℠, Chase QuickPay with Zelle®, or direct deposits. Chase College Checking account is open to college students who are years old.